Cyclical Markets is an uncorrelated investment research company that gives active traders and investors of all types massive clarity and understanding of the S&P 500’s exact movements

Haven’t read my book? Download it RIGHT NOW to understand why this strategy is different than any other and check your email for a special offer for the 2024 grand opening!

How to be your own fund manager trading just the SP500

Dear Trader: LEARN THE 80 DAY CYCLE

With CYCLITECNICAL information by your side, its alot easier to find peaks and troughs

Using a timely and flexible system with rigid, scientific rules will help you create positive results, over time

Determining the direction, strength and characteristics of the SP500 index for discovering opportunities throughout the American stock markets has never been easier for discretionary traders and investors

Take a look at my book to understand why this strategy is different than any other

***and I will send you the crazy 10x 2024 Grand opening offer***

………………..…the 80 day cycle, Derek? 🤓😂

Yes… read the book..

Then look at the FOUR TOOLS below

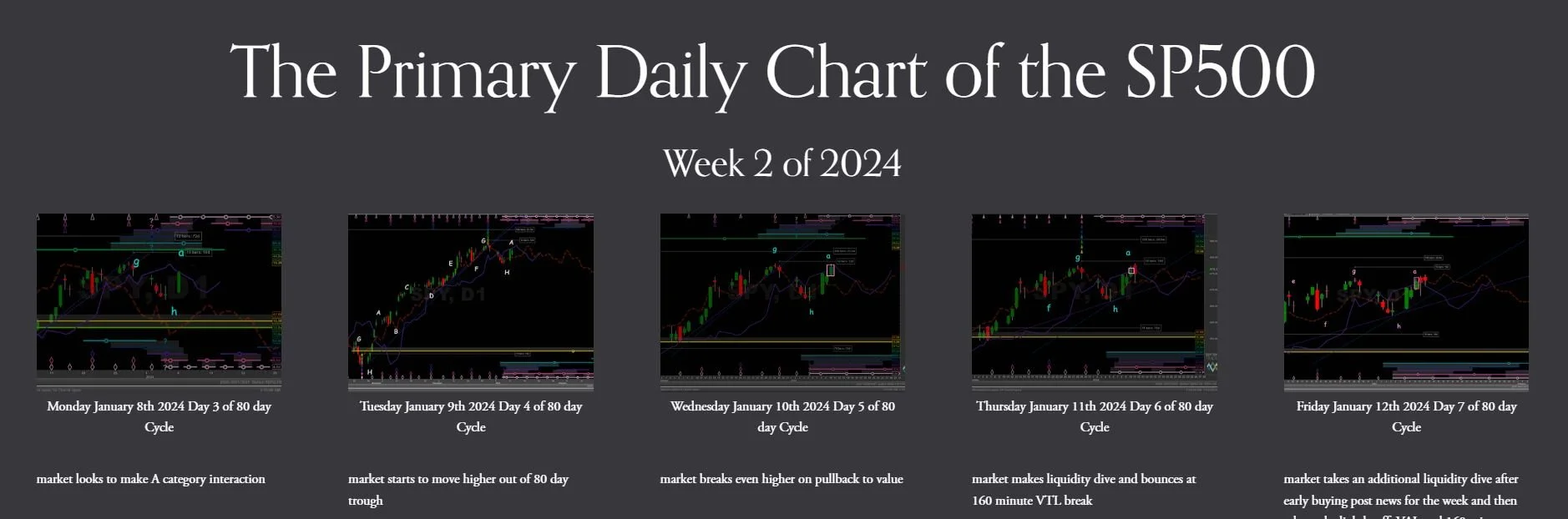

SP500 Trading Chart

In order for clarity of the market’s movements to be formed in the trader’s mind, the trader must see it on a chart, clearly and easily

🏅track price’s movements through the 80 day cycle used by all our traders following the principles of cyclitecnical analysis

🏅equities strongly synchronize with this chart’s peaks and troughs

🏅shows price’s interactions as taught by the father of computerized technical analysis 60 years ago updated by the work of the best cyclitecnical analysts as shown in my book

🏅all charts are saved and archived for each day, complete with trade records and alerts of our trading

Sp500 Daily Update - Video Analysis

Each trade opportunity lasts from days to weeks and have nuances and instructions that have to be taught and reiterated consistently

🔮anticipate the expected price movement for the next few days

🔮will it be bullish, or bearish and why..?

🔮identify the day type due to its time position

🔮shows where to get in a trade for continuation or reversal or exit

🔮learn WHEN & WHY we trade with cyclitecnical info

Data Mine Journal

Our daily preparation journal helps you compare the past with today and we keep you accountable by checking yours

✨25 point checklist like a briefing/debriefing used in the military

✨shared before, during and after each trading day

✨the last stop in knowing what is going to happen in SP500

✨its recommended that all traders SHARE it with us

✨benefit from knowing about the phenomenon of repetition

Enter the world of cyclitecnical trading… download my book at the top of the page to get sent the crazy offer

Cyclical Markets: Clarity, Accuracy and Understanding in Trading

-

Yes I can count 5 people and they all are great to varying degrees and would highly recommend all my colleagues’ material because they know when the equity indexes are peaking and bottoming to a high degree of clarity. The proper pulling of the trigger is all up to the individual manager.

-

Risk management. Because the research includes rulesets, e.g. when a peak is broken or a trough is broken… dont do “X”, because it goes against the 8 principles of cyclitecnical data, its much easier to pass on trades or contributing additional analysis time to an asset that has a lack of clarity. So we can stay away from telling our members to hold bags or stop out too often. Of course stops happen, and losers as well. But the portfolio should be a sound place of reason long term and in the short term, should make psychological sense if it is a true idea generation service. This would not be complete without knowing where and when (and why) to stop doing something. The research and the rulesets help alot with that. You will come to know these for yourself. Come in for a while and you wont look at charts or the markets the same again

-

Secure portal for daily research service, email support help direct to the team, asynch video for personalized responses, group chat

-

Derek wanted to invent a word for traders to compare the true nature, and notice the difference in skill level, of this type of trading with the normalized term “technical analysis” and understand it has to be acknowledged that it is quite separate and discrete from “cyclical” . This is because its not taught in books or classes or courses in traditional analysis. And its requires a full completion of study that is unlike any other analysis. He always say we work well with CFAs and managers because it is so new to them that they love it because it works

-

Derek learned from the Hurst cycles course in 2012 and then from David Hickson over the following years. Since then he has been researching how to make money with cycles. What you see is the culmination of working in analysis and reporting those observations to the public as well as trading full time in the markets

-

We think you should go slow to incorporate it without being drastic. You are inevitably going to find something useful for yourself from our work. The best way to make gains from our suggestions on the market is to ask questions and install a new belief system that lets you believe that cycles are pervasive in the world and financial markets. After all, Derek is not the lead researcher. It was JM Hurst who proved the Eight Principles of Cyclitecnical Analysis over 50 years ago. We think traders just dont know about his work and really wont have the time to do it or faith without a TRUSTED PERSON to guide them to an elevated place of knowledge

-

The Principles are Cyclicality, Commonality, Summation, Harmonicity, Synchronicity, Proportionality, Nominality and Variation so its probably best to start reading in conjunction with your membership. We realized this would be an issue, so we created a group of traders and had the course that Hurst released over 50 years ago updated for you to search through digitally. Its all part of your membership and is available inside

-

Clearly defined times when to “hold”, when to “fold” and when to go “large”

Charts zoomed in to detailed sequences and interactions of our research w/ price

The Data Mine worksheet will aid you in your approach to being ready each day for the market’s movements in a way that you have never been before. It is filled out by Derek when data comes in and before and after each day

Weekly: Trader Accelerator LIVE recorded webinars

Bonus: periodic additions of timely analysis from the cyclitecnical community of peers and advisors that we’ve built up over 12 years of collaboration and research; interviews for day trading outside the community

-

You dont want to ditch your CTA, your fund manager, your CFA or your favorite newsletters. Our service is designed to be incorporated alongside Fundamental Research and in fact its meant for people with other information to have that last piece of knowledge necessary to pull the trigger on their best ideas that are in agreement with the Cyclical Markets service. Technical analysis has really no place in a modern repertoire of trading tools. Hurst cycles (cyclitecnical data and rulesets) supersede and provide all the “technical” a trader needs.

-

Dont tell them you got it from us if you dont want to. We’re going to publish regardless. If you see something you like, just take it for your own analysis. As long as you trust us, we’re fine if you say you found this clarity yourself. One of the best things professionals and retail traders can do is to KNOW when NOT to trade. This makes you look good. We love that about this research. Do nothing, feel confident watching everyone scramble and play defense. Say goodbye to overly hedged positions. Say goodbye to FOMO. Say goodbye to resentment and fear.

-

We want our members to understand the analysis and the actions that are specific to it. Therefore if you are worried about a position or decision, its best for you to email us and we’ll respond fast, and we can do a back and forth video chat over VideoAsk

-

Our service is tailored to a target market of traders that wish to trade actively and learn while they earn.

-

We’re building a concept to allow traders to enter a “fund of one” arrangement as well as allow us to manage their account. This concept will be helpful to traders and investors, and groups that want to learn how the trading decisions are made, get access to proprietary auto trading strategies, and meet the people behind the screens in the countries that we work.

Cyclical Markets Group

An accompanying knowledgeable source of insight into the daily market structure of various markets around the world

A trader can use the data mine worksheet, the primary daily chart and the narrative video to start trading the SP500 options trading strategy right away, but we realize that there are many opportunities in the markets each day, so:

You can ask questions directly to us and talk to other contributing members through anonymized group chat (DISCORD)

We host the Cyclitecnical Trader Accelerator: Tuesdays at 11AM EST

DISCLAIMER: If you want to keep your day job (yeah, we want you to) think about this as a part time business in trading research that you will grow to be accustomed to with effort and time; dont think of it as a get rich quick scheme, and dont think you will find success so easily without alot of work and time spent in the actual markets. That being said, we think that you will appreciate your new-found knowledge and that you wont have to go down the rabbit hole and/or dive into a 15 year process of destruction in your private life if youre doing trading at home by yourself. And, about you professional traders out there…maybe you can 10x your status and reach personal fulfillment by completing your CYCLI-tecnical analysis and trading education.

Signed,

Derek Frazier and team at Cyclical Markets

Derek keeps a model portfolio with hypothetical performance for the public in a spreadsheet that you can view here.